Let’s get started!

Ready to find your next investment property on Stash?

At Stash, we’re helping thousands of people get into property investment every day, whether that is through property development, property renovation or rental properties. Our platform offers a variety of tools and resources to help investors research and evaluate potential investment opportunities, connect with like-minded individuals, and manage their portfolios with ease.

With Stash, investors can feel confident in their decisions and take control of their financial futures. Whether you’re a seasoned investor or just getting started, our platform is designed to help you achieve your property investment goals.

Try Stash today

Stash helps property investors find investment ready properties faster. Try it free for the next seven days.

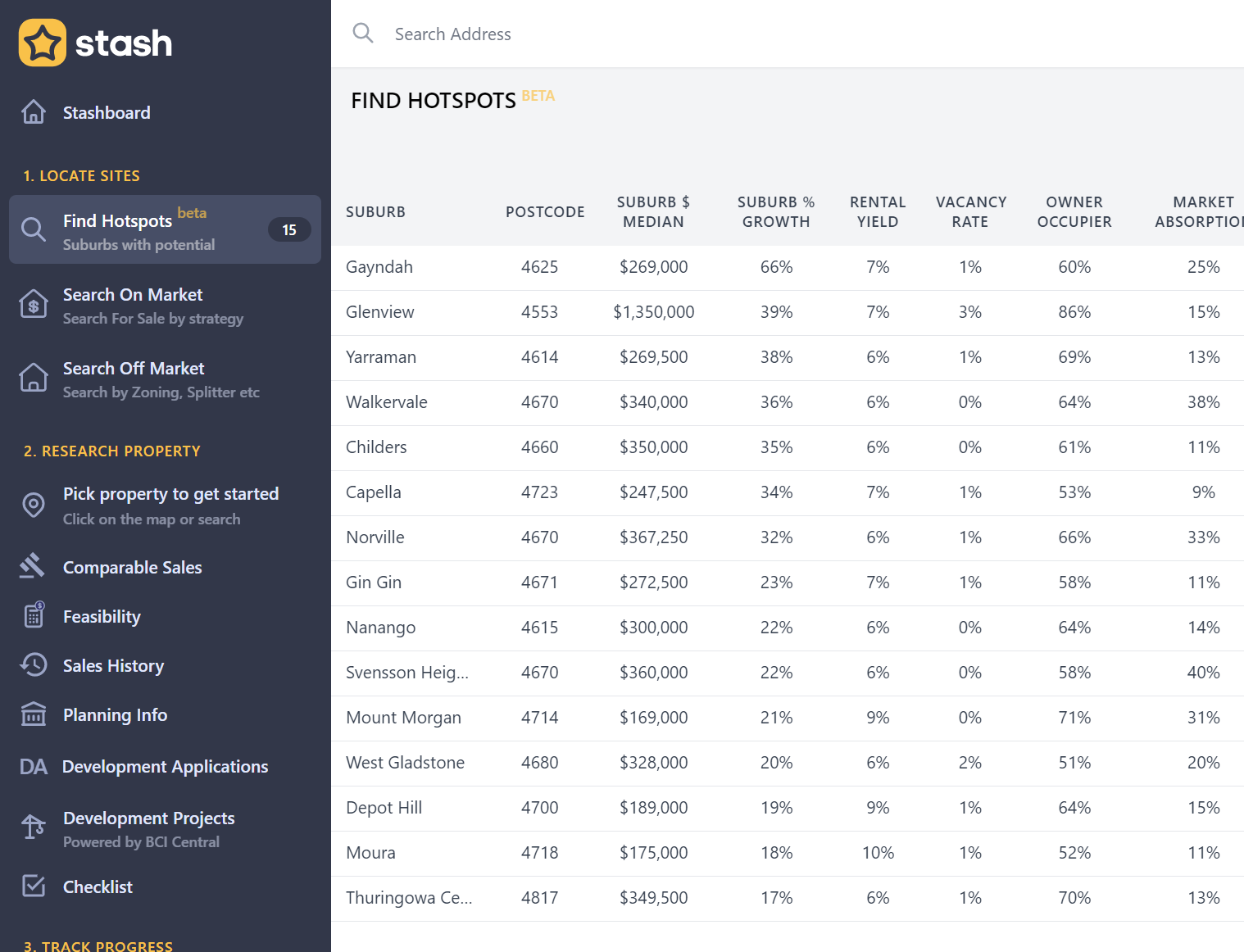

First. Hotspots will help you discover the suburbs that are poised for growth, have the lowest vacancy rates, the highest yields and lowest days on market to help you find the best property deals.

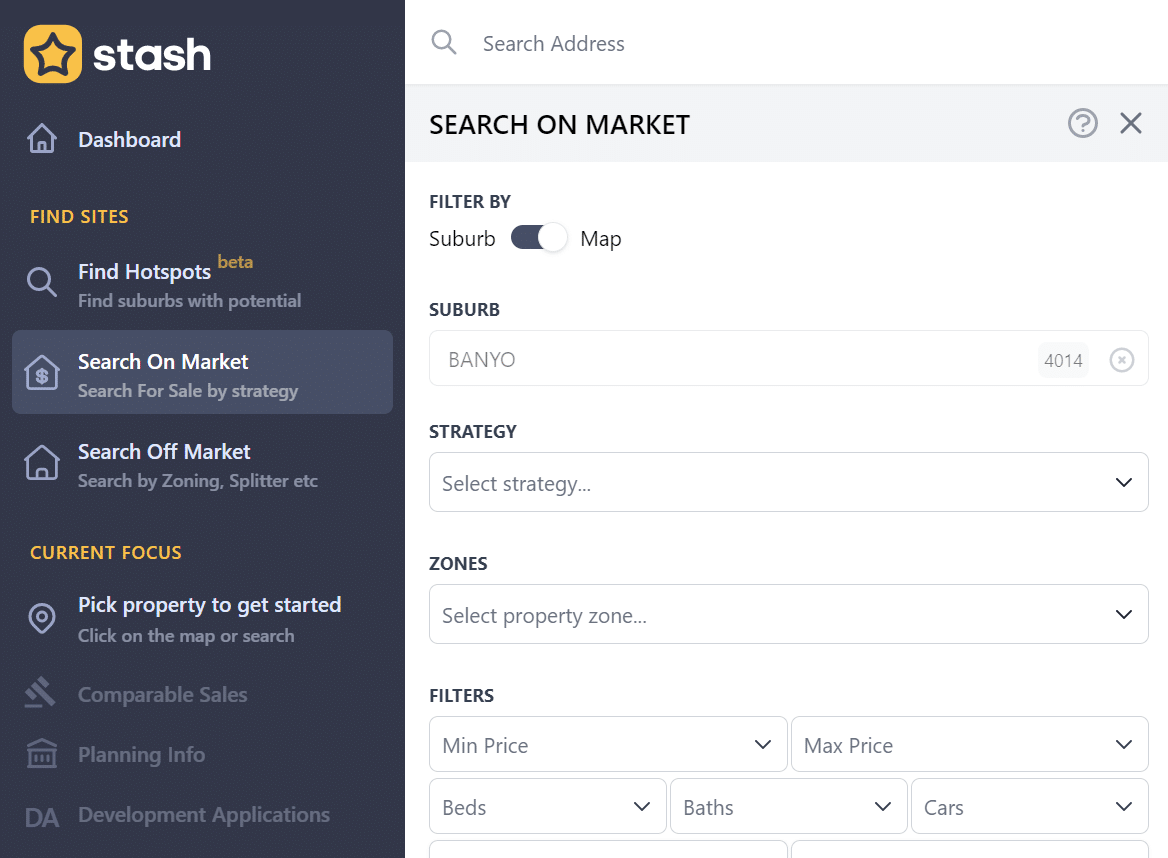

From there, you can search for your next renovator, bargain buy, distressed sale or development ready property with our On Market search

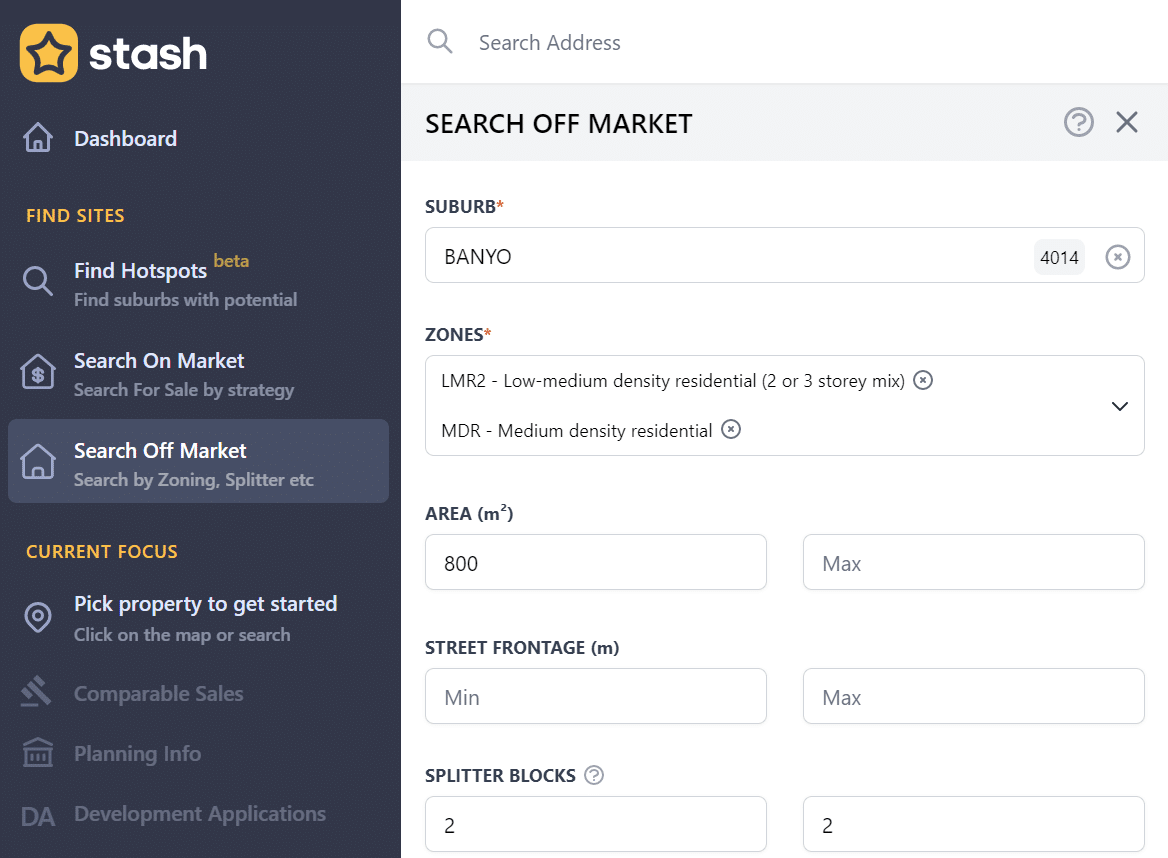

Looking to find your next development site before they hit the market? Why not search Off Market for splitter blocks or refine your search further using our zoning search. You can even send letters to prospective sellers via our in-built mail house.

Once you’ve found a property, we will tell you everything you need to know. From sales history to comparable sales to nearby development applications & projects in the pipeline.

Find on market & off market investment ready properties investor with Stash.

Is now the right time to invest in property?

Investing in property is a major decision that requires careful consideration and research. The current economic climate has left many potential investors wondering whether now is the right time to take the plunge.

As with any investment decision, the answer to whether now is the right time to invest in property in Australia will depend on your individual circumstances and investment goals.

It is important to remember that property investing comes with risks. Property prices can be volatile, and there’s always the risk that you’ll lose money if the market takes a downturn. Additionally, there are ongoing concerns about the impact of the pandemic on the Australian economy, which could impact the property market in unpredictable ways.

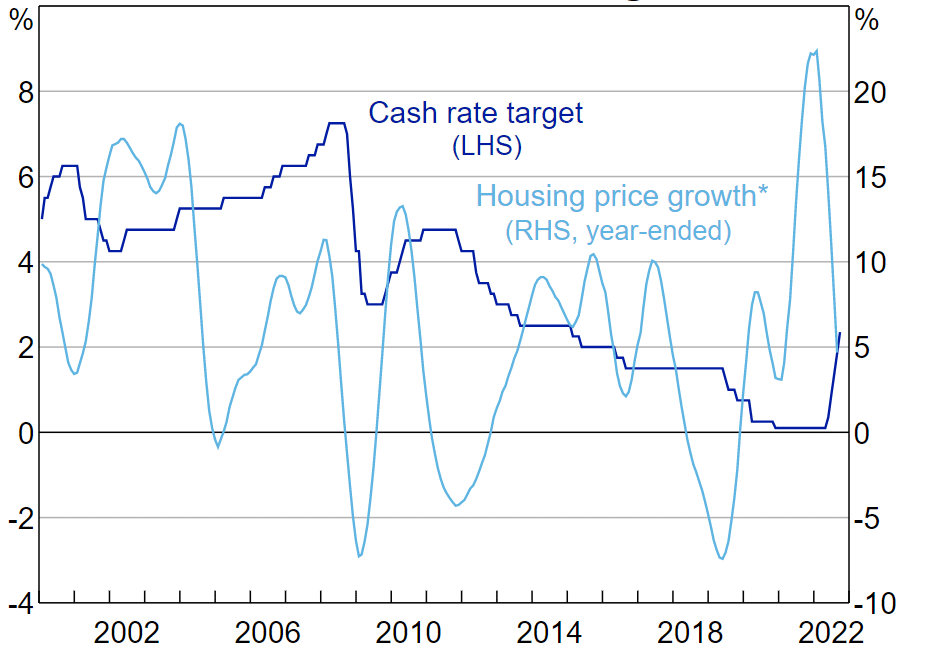

Cash Rate Target. Source: RBA

History never repeats? Or does it? As of 2019-20, there were 2,226,841 people who have taken the leap into property investment. 1,592,883 owned one property, 418,637 owned two properties, 129,390 owned three properties, 46,765 owned four properties with a smaller number of investors owning five properties (19,271 people) or six or more (19,895 people).

Location, location, location

Investing in property is a great way to build wealth and secure your financial future. However, with so many different areas to choose from, it can be challenging to determine the best places to invest.

Things to look for…

- Look for areas with strong growth potential

- Research local supply and demand dynamics

- Consider the potential for capital growth

- Evaluate the rental yield potential

- Seek professional advice

When considering these factors, it’s important to think about the specific location you’re interested in and to gather as much information as possible about the local property market. By doing so, you can make informed decisions and increase your chances of success in the property market.

Find the right areas to invest in with Hotspots. Only on Stash.

Suburb Growth: The change in median home values in a specific suburb over a 12-month period. A positive growth rate indicates an increase in home values, and a negative rate indicates a decrease. Pro Tip: Previous growth is no guarantee of future growth, so you may want to search for suburbs that are yet to see growth.

Vacancy Rate: The percentage of rental properties in a specific area that are unoccupied or available for rent, calculated over a 12-month period. It indicates the demand for rental properties in an area. Pro Tip: You will want to make sure there is someone who is going to rent your property. A low vacancy rate is what you are after.

Market Absorption: The rate at which available properties are sold in a specific area over a 12-month period, indicating the demand for properties in the area and the overall health of the real estate market. Pro Tip: A high market absorption indicates the percentage of properties on the market that sell each month. The higher, the better.

Rental Yield: The annual rental income from a property as a percentage of its value, calculated over a 12-month period. It provides an indication of the potential return on investment for a rental property. Pro Tip: A rental yield of 5-6% might just cover your mortgage repayments, so it’s a better chance of being positively geared.

Owner Occupier: The percentage of homes in the area that are occupied by their owners, as opposed to being rented out. This statistic provides an insight into the nature of the housing market in a specific suburb. Pro Tip: Do you want to buy in a suburb with renters as neighbours or established homeowners?

Days on Market: The average time properties in the area stay on the market before being sold or taken off the market, calculated over the last 12 months. It reflects the demand and competition for properties in the area. Pro Tip: If you are looking to flip, how quickly will you be able to sell it? Days on Market is a good guide to how long you might be waiting.

Select your investment strategy

Buying a property is a significant investment that requires careful consideration and planning. One of the key decisions you’ll need to make when purchasing a property is whether to buy on-market or off-market.

Search On Market

On-market properties are properties that are listed publicly through an agent, on real estate websites, or in print media. They’re available for all potential buyers to see, and you’ll likely be competing with other buyers to secure the property.

Pros:

- On-market properties are easy to find and research, as they’re listed publicly.

- As the buyer, you have the opportunity to negotiate with the seller directly or through their agent.

- You have the option to make an offer conditional on various aspects of the property (such as building inspections, financing, etc.) before purchasing.

Cons:

- You’ll likely face competition from other buyers, which can drive up the price and make it harder to secure the property.

- On-market properties may have less flexibility in terms of settlement timeframes, as the seller may be looking to sell quickly.

- You may miss out on properties that are quickly snapped up by other buyers.

Stash analyses every property on market for the best investment

Search Off Market

Off-market properties, on the other hand, are not listed publicly. They’re usually sold through private channels, such as a real estate agent’s network, and are often only available to buyers who have specifically requested to see them.

Pros:

- You may have less competition from other buyers, giving you more time to consider the property and make an offer.

- Off-market properties may offer more flexibility in terms of settlement timeframes and conditions of sale.

- You may be able to secure a property at a lower price, as there may be less demand for off-market properties.

Cons:

- Off-market properties can be harder to find, and you may need to work with a real estate agent who has access to off-market listings.

- As the buyer, you may have less bargaining power when negotiating with the seller, as they may not be actively seeking to sell.

- There may be more uncertainty around the property’s condition and history, as it may not have undergone the same level of public scrutiny as on-market properties.

Target every property in the country with Stash’s Off market search

Did you know? Stash offers an in built mail house so you can approach off market properties in seconds. Looking for that perfect investment or development site? It might only be a couple of dollars away.

Find the right property

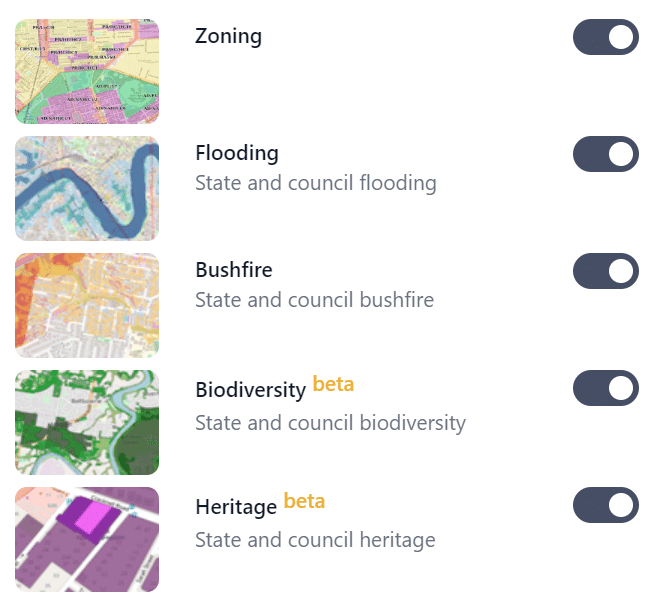

When buying a property, it’s important to do your due diligence and conduct various checks to ensure that the property is suitable for your needs and that you’re aware of any potential risks or limitations. Four key checks to consider include flood, bushfire, heritage, and biodiversity checks.

Flood and bushfire checks can help identify whether the property is located in an area at risk of these natural disasters, allowing you to assess the potential impact on the property and factor in any necessary precautions or insurance coverage.

Heritage checks can identify whether the property is of historical or cultural significance, which may affect your ability to renovate or alter the property.

Biodiversity checks can help identify whether the property is located in an area of high ecological value, which may limit development or require special permits or approvals.

By conducting these checks, you can ensure that you’re making an informed decision and that you’re aware of any potential risks or limitations associated with the property. This can help you avoid any costly surprises down the line and ensure that the property is a good fit for your needs and investment goals.

Find on market & off market investment ready properties investor with Stash.

Did you know that when buying a property, conducting flood, bushfire, heritage, and biodiversity checks can help you make an informed decision and avoid costly surprises? These checks can identify potential risks or limitations associated with the property, such as its location in a flood or bushfire zone, its historical or cultural significance, or its ecological value. By considering these factors, you can assess the potential impact on the property, factor in any necessary precautions or insurance coverage, and determine if it aligns with your needs and investment goals.

Pay the right price

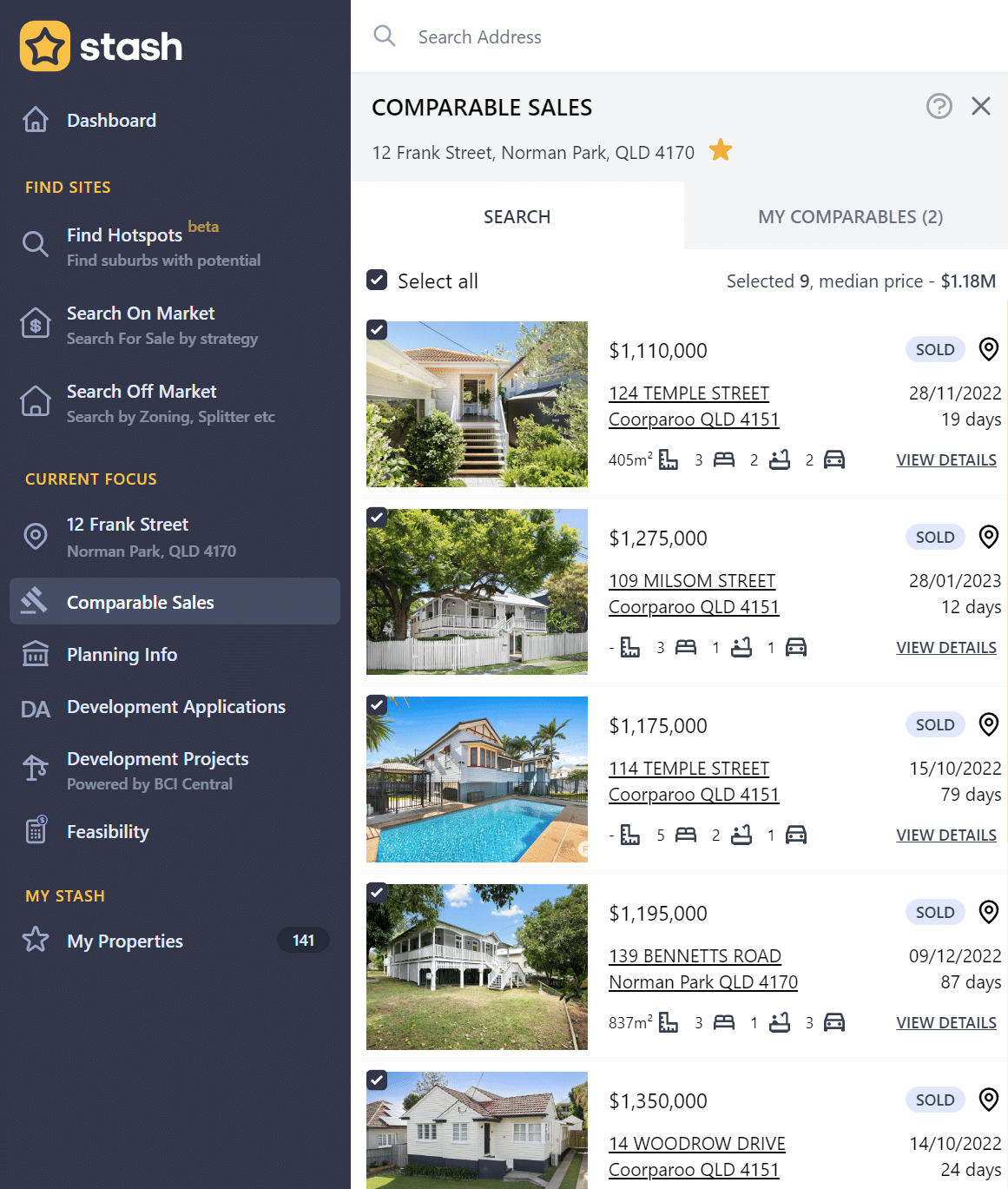

When buying a property, it’s crucial to ensure that you’re paying the right price. One key tool in determining this is the use of comparable sales, also known as “comps.” Comps are recent sales of similar properties in the same area, and they can provide valuable insight into the local property market and the fair value of a property.

By comparing the property you’re interested in to similar properties that have recently sold, you can identify any differences and make adjustments to the property’s value accordingly. This ensures that you’re paying a fair price for the property and can help you avoid overpaying. Without using comparable sales, you may be at risk of paying too much for a property, which could negatively impact your investment returns in the long run.

Find on market & off market investment ready properties investor with Stash.

Did you know that when buying a property, using comparable sales, or “comps,” can help ensure that you’re paying the right price? Comps are recent sales of similar properties in the same area, and they provide valuable insight into the local property market and the fair value of a property. By

You can start a free trial of Stash below or connect with our team who can help put you in touch with some of Australia’s leading property investment and wealth educators.

Find your needle in the haystack today. Sign up for our free trial and start finding great deals fast!

Happy Stashing!