Why Choosing the Right Target Market Matters

Selecting the right target market is crucial to the success of your property investment endeavours. A well-chosen market can significantly impact your returns and help you achieve your investment goals. In this article, we will discuss the importance of choosing a target market, provide guidance on conducting market research, and offer tips for identifying the most promising markets for your investment strategy.

The Importance of Choosing a Target Market

Identifying the right target market for your property investment is essential as it plays a significant role in determining the potential for capital growth, rental yield, and overall return on investment.

By focusing on a specific market, you can tailor your investment approach to meet the unique demands and preferences of that market, which may ultimately contribute to a more successful and profitable investment experience.

Take the 7 day challenge

Stash partners with some of the leading property investment & development educators in Australia.

Become a member of Stash to learn the ropes on becoming a property investor or developer. Take the 7 day challenge and get free access to Stash to begin your path to financial freedom.

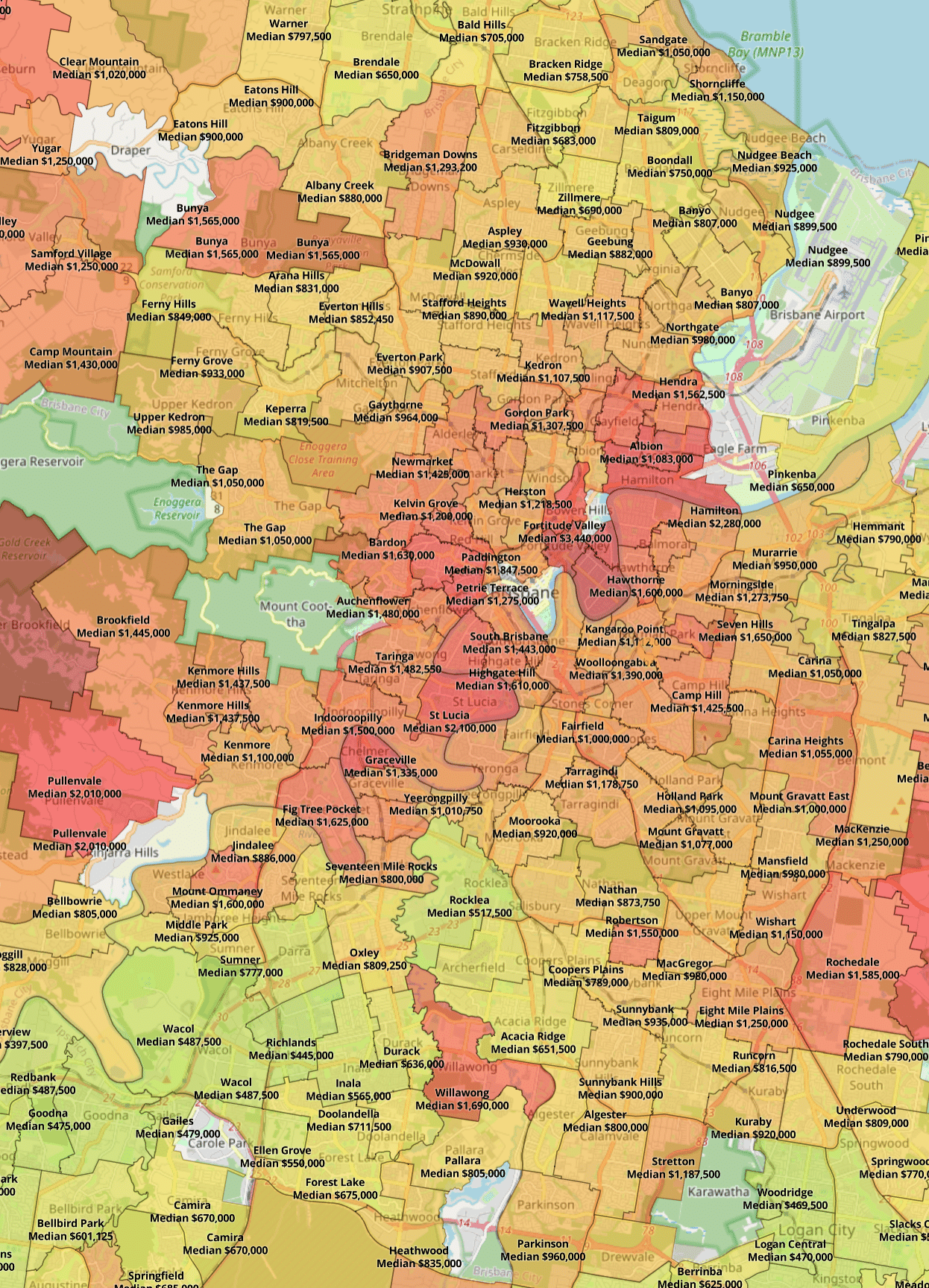

Stash can help identify areas with potential growth or yield

Tips for Identifying Promising Markets

To identify the best target market for your investment strategy, consider the following factors:

- Look for areas with strong population growth: High population growth often indicates a strong demand for housing, which can lead to increased property values and rental yields. Pay attention to demographic trends, such as an influx of young professionals or families, as this may suggest demand for specific property types and amenities.

- Assess local job opportunities: Markets with strong employment opportunities tend to attract more potential tenants or buyers, driving up demand for housing and improving your investment prospects. Research the area’s major employers, upcoming business developments, and overall economic health to gauge the potential for job growth.

- Consider infrastructure developments: Areas with planned or ongoing infrastructure projects, such as new transportation links or commercial developments, are likely to experience increased property values as these improvements make the area more desirable. Keep an eye on local government plans and announcements to stay informed about potential infrastructure projects.

- Examine historical trends: Analysing past property market performance can provide valuable insights into the potential future growth of a particular market. Study historical data on property values, rental yields, and vacancy rates to identify patterns and trends that may continue in the future.

- Consult with local experts: Real estate agents, property managers, and other local professionals can provide valuable insights into the current state of the market and its future prospects. Networking with these experts can help you stay informed about local market dynamics and uncover hidden investment opportunities.

Stash can help identify areas with significant growth.

- Monitor property listings and sales data: Keep track of property listings, sales data, and auction clearance rates to gauge the level of competition and demand in the market. This information can help you determine whether a market is over-saturated or ripe for investment.

- Assess the affordability of the area: A market that is more affordable compared to its surrounding areas can attract a higher number of potential tenants or buyers, resulting in increased demand and potential for capital growth. Research median property prices and rental rates to determine the relative affordability of a target market.

Selecting the Best Market for Your Investment Strategy

When choosing a target market, consider the following tips:

- Align with Your Investment Goals: Ensure your chosen market aligns with your investment goals, whether you’re seeking capital growth, rental income, or portfolio diversification.

- Match Your Budget: Select a market that fits within your budget, taking into account factors such as property prices, ongoing costs, and potential returns.

- Diversify Your Portfolio: Consider investing in different markets to diversify your portfolio and spread risk across various geographic locations and property types.

- Look for Growth Indicators: Focus on markets with strong growth indicators, such as population growth, economic development, and infrastructure projects, which can contribute to capital growth and rental demand.

- Monitor Market Conditions: Keep an eye on market conditions and be prepared to adjust your target market selection if necessary to capitalize on emerging opportunities or mitigate risks.

Choosing the right target market is a critical step in your property investment journey. By conducting thorough research and analysing factors such as capital growth potential, rental demand, and infrastructure developments, you can identify the most promising markets for your investment strategy.

Ensuring your chosen market aligns with your investment goals, budget, and risk tolerance will set you up for success and help you maximise your property investment returns.