What High IQR % Median Means for Investors

Investing in properties that offer renovation potential is a time-tested strategy for achieving substantial returns. However, finding these ‘diamond-in-the-rough’ suburbs can be tricky without the right tools and knowledge.

One lesser-known indicator that savvy investors are increasingly turning to is a suburb’s Interquartile Range (IQR) percentage relative to the Median Price. Unlike traditional metrics that rely solely on averages or medians, the IQR metric sheds light on the distribution of property prices within a suburb. By comparing the spread between lower and upper quartile prices to the median, this metric helps investors uncover suburbs where the disparity between property conditions might offer valuable renovation opportunities.

But what exactly does this mean, and why does a high IQR % Median signal good renovator opportunities?

Understanding the significance of this metric and how it applies to the property market can open doors to lucrative investments in areas where improvements can lead to substantial gains.

Get a free trial

Stash partners with some of Australia’s leading buyers agents, empowering them with the tools they need to streamline the entire property-buying journey.

Become a member of Stash BA to take your buying business to the next level. Try it free for 14 days.

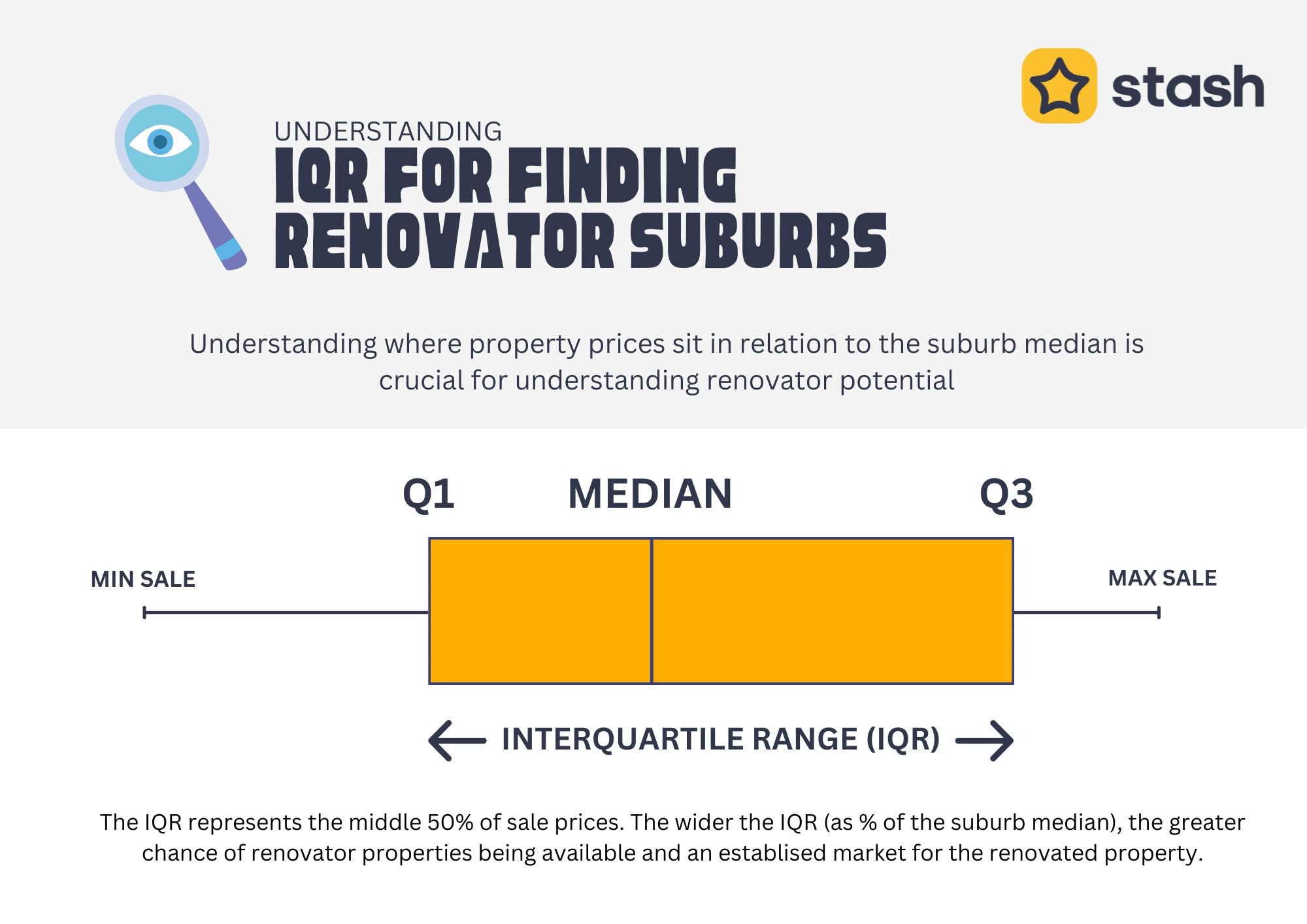

Stash can help you find suburbs with renovator potential in seconds.

Understanding Interquartile Range (IQR)

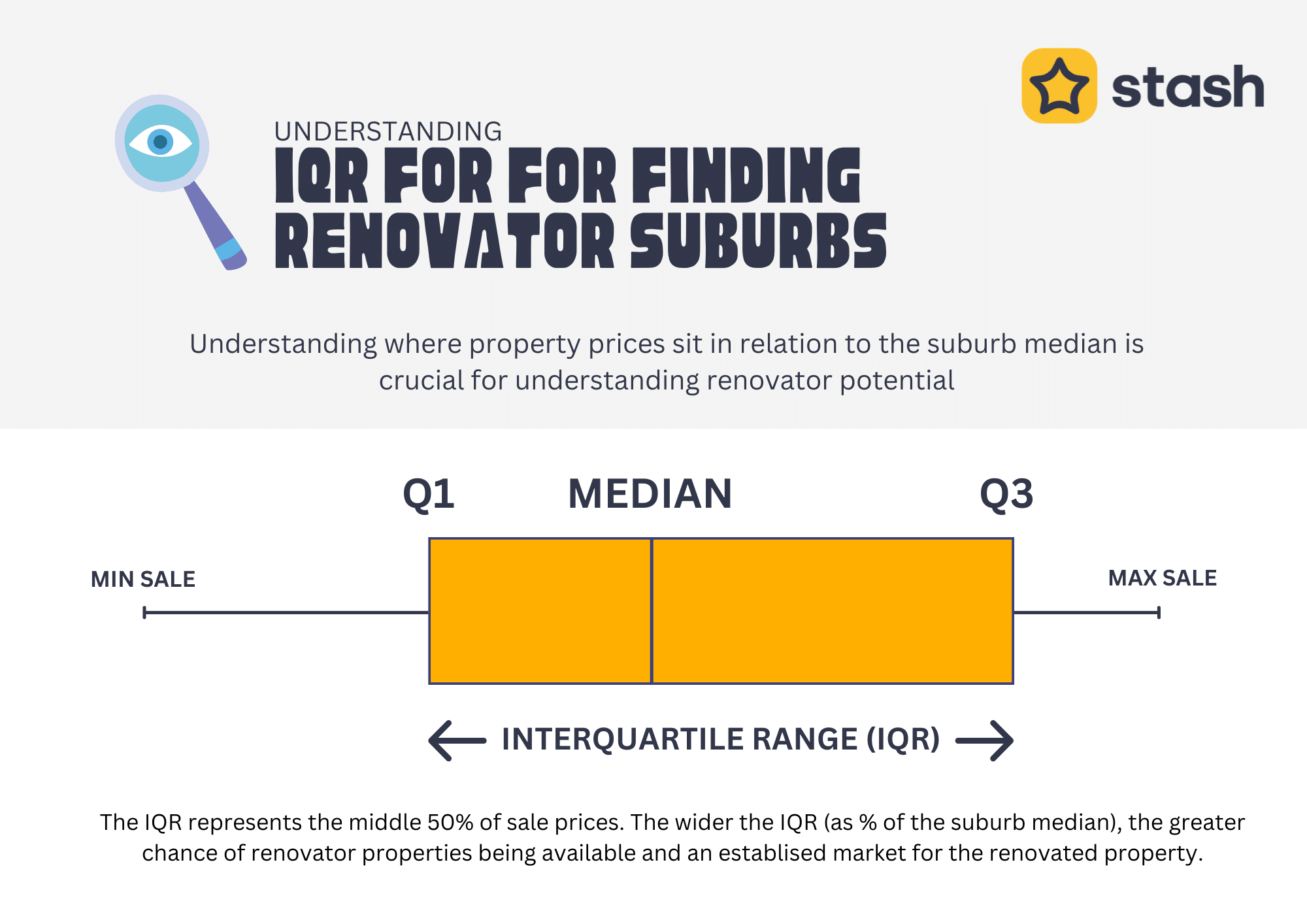

In property market analysis, the Interquartile Range (IQR) represents the spread of the middle 50% of sales prices within a suburb. Essentially, it measures the gap between the 25th percentile (lower quartile) and the 75th percentile (upper quartile) of property prices. This metric helps to show how varied property prices are in a given market. e.g. If there was 100 sales in a suburb, the median is the 50th sale (when sales are sorted by price range). The 25th percentile is the 25th sale and the 75th sale is the 75th percentile.

A high IQR relative to the median price suggests a substantial difference between properties that are relatively cheaper (potentially run-down or older) and those at the upper end of the spectrum (which may already be renovated or newer). This variation signals that there are properties with potential for value-add renovations within the same suburb, where bringing a lower-priced property up to the standard of higher-end properties could yield significant profit.

Understanding where property prices sit in relation to the suburb median is crucial for understanding renovator potential

Why High IQR % Median Indicates Renovation Potential

Opportunity for Value Addition

When you see a high IQR % Median, it indicates that the price difference between the lower and upper quartiles is substantial. In simpler terms, there are opportunities for lower-end properties (in terms of pricing) to be improved and potentially moved up closer to the higher quartile of prices. For example, if the IQR in a suburb is 30% or more of the median price, it indicates that the properties at the lower end of the price range could benefit from upgrades to match the pricing of those at the higher end.

Diverse Property Stock

A large spread in property prices often points to diverse housing stock within a suburb. This diversity can stem from factors like a mix of older houses, unrenovated properties, and recently updated homes. Suburbs with such a mix are often in transition and present opportunities to identify properties that can benefit from aesthetic or structural improvements.

Potential for Uplift

The higher the difference between the lower and upper quartiles, the greater the potential uplift for properties in need of renovations. Suburbs with a high IQR % Median often have untapped potential that, when realised, can lead to significant capital growth. Investors who can spot properties in the lower quartile and bring them closer in line with those in the higher quartile stand to benefit from a solid return on investment (ROI).

How to Identify High IQR % Median Suburbs?

Using Stash Property’s platform, you can quickly pinpoint suburbs with high IQR % Median, giving you a competitive edge in identifying renovation opportunities. Here’s how:

1. Access the ‘Find Suburbs’ Feature

Start by accessing the feature that provides insights into top-performing suburbs based on various criteria, including IQR % Median. This feature filters through hundreds of suburbs to surface those with substantial price spreads between quartiles, indicating renovation opportunities.

2. Apply the IQR % Median Filter

Use the built-in filter to sort suburbs by their IQR as a percentage of the median price. Look for suburbs where this percentage exceeds 30% or more (up to 60%). This indicates that a significant spread exists between lower-priced and higher-priced properties, highlighting renovation potential. Note: Some coastal suburbs may falsely indicate renovation potential so you may want to exclude these.

3. Use On-Market Search to Locate Underpriced Properties

Once you’ve identified promising suburbs, switch to the on-market search feature. Focus on properties priced below the suburb median within these suburbs. Our AI-powered tool can further refine your search by highlighting properties that are likely to be undervalued or those that have been on the market for extended periods, giving you negotiating leverage.

4. Evaluate Renovation and Profit Potential

Finally, use the insights from our platform to evaluate the potential renovation costs versus the uplift in value. Compare the current pricing of unrenovated properties with recent sales of renovated homes within the same suburb. This will help you gauge whether the cost of renovations aligns with the projected profit margins.

Not every suburb is equal. Save time in identifying suburbs with renovation potential with Stash Property.

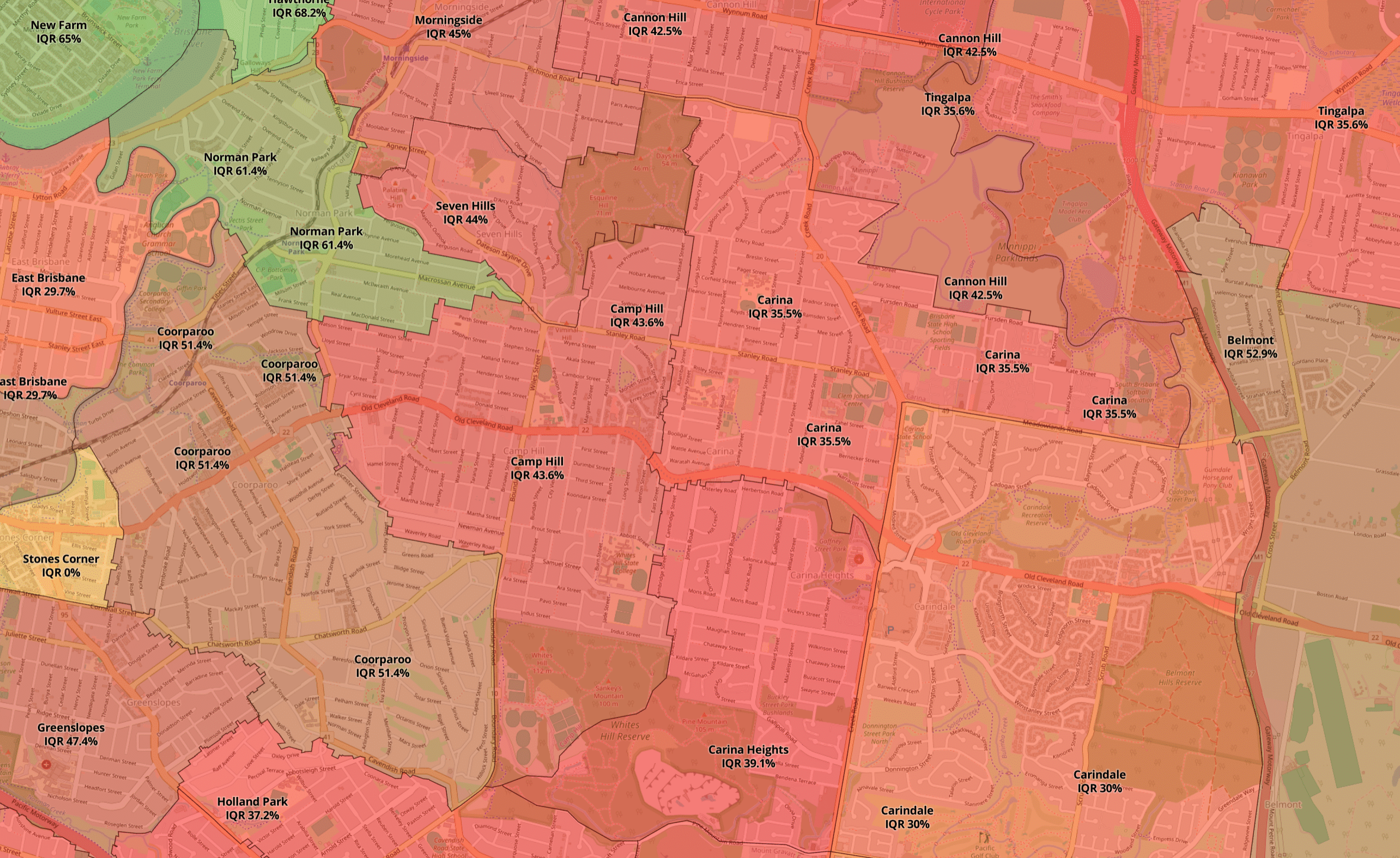

Example One: Camp Hill, Qld 4152

Camp Hill has a median price of $1.6m with a low range of $1.31m and a high range of $2m. The IQR is $696k which represents 44% of the suburb median. The goal for renovators is to seek properties at the lower end, renovate and sell at the higher end.

Example Two: Yarrabilba, Qld 4207

Yarrabilba has a median price of $640k with a low range of $590k and a high range of $682k. The IQR is $102kk which represents 15% of the suburb median. This suburb is likely not suitable for renovation as most houses sold are similarly priced.

Finding renovation opportunities can significantly boost your returns, but it requires understanding the nuances of property data. A high IQR % Median is a key indicator of diverse property stock and suggests that opportunities exist to add value through strategic renovations.

With Stash Property’s cutting-edge tools and insights, you can confidently identify and act on these opportunities. Leverage features like ‘Find Top Growth & Yield Suburbs’, on-market search, and property timeline insights to navigate the market with precision.